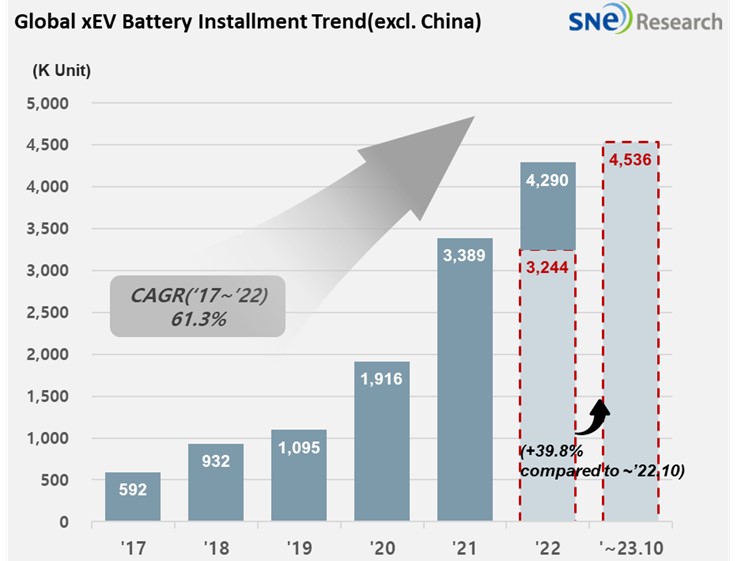

From Jan to Oct in 2023, Non-China Global[1] Electric Vehicle Deliveries[2] Posted 4.536 Mil Units, a 39.8% YoY Growth

- Tesla top the list while Hyundai-KIA ranked 4th in the non-China EV market

From

Jan to October in 2023, the total number of electric vehicles registered in

countries around the world except China was approximately 4.536 million units,

a 39.8% YoY growth.

(Source: Global EV & Battery Monthly

Tracker – November 2023, SNE Research)

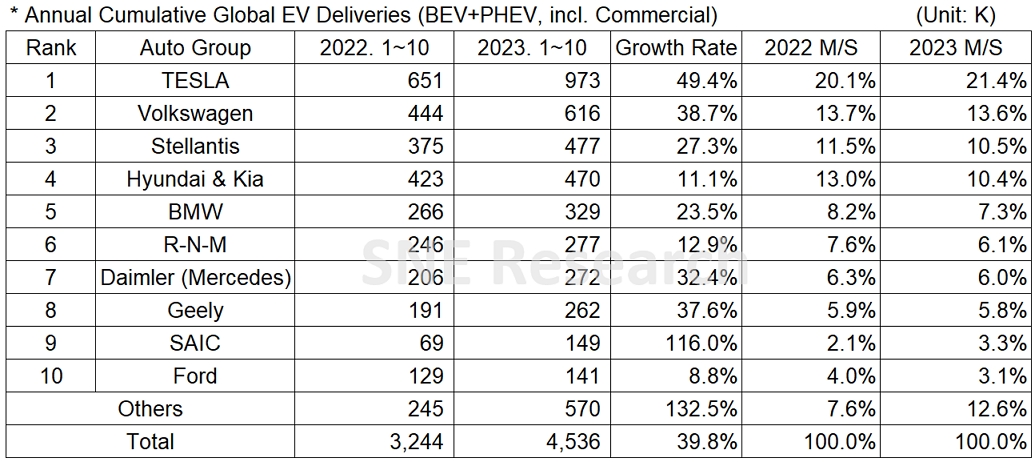

From Jan to Oct 2023, if we look at the number of electric vehicles sold by OEM groups in the non-China market, Tesla remained at the top with a 49.4$ YoY growth driven by the price-reduction strategy from earlier this year and the tax credit offered to Model 3/Y by the US government under the US IRA. The VW Group, where Volkswagen, Audi, and Skoda belong to, recorded 38.7% YoY growth, taking the 2nd position. The growth of VW Group was led by favorable sales of Audi Q4 and Q8 E-Tron as well as ID.4, a first, non-American EV model qualified for the tax credit offered by the US government. The 3rd place was captured by the Stellantis Group maintaining solid sales of both BEV and PHEV such as Fiat 500e, Peugeot e-208, and Jeep Wrangler 4xe.

(Source: Global EV & Battery Monthly Tracker – November 2023, SNE Research)

Hyundai-KIA Motor Group posted a 11.1% YoY growth supported by sales of its main models such as IONIQ 5/6 and EV6 as well as Niro BEV and Tuscan and Sportage PHEV that are sold well in overseas markets. The group, breaking the highest profit record, as profit in a third quarter, in Q3 this year, announced that it would focus on expanding its market share by enhancing the global awareness of its EV-dedicated brand, IONIQ, and increasing the sales of eco-friendly vehicle through strengthening the hybrid line-up.

(Source: Global EV & Battery Monthly

Tracker – November 2023, SNE Research)

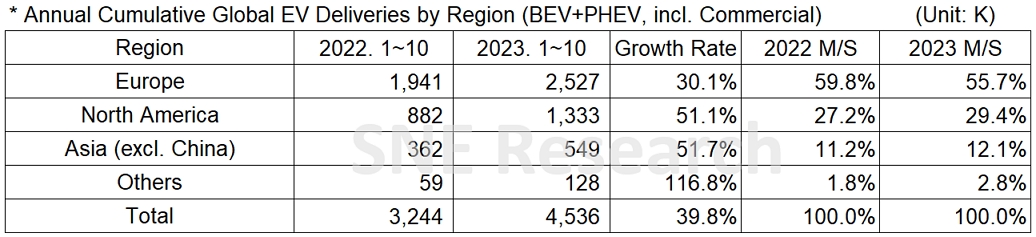

By

region, in the European market, the VW Group and Stellantis Group both enjoyed

favorable sales, while Volvo by Geely Auto and MG under the SAIC’s umbrella stood

out in terms of growth. It can be analyzed that MG’s strategy to introduce

electric vehicles at affordable prices has worked in the European market,

coupled with a shift in the trend of EV market from performance to cost-effectiveness.

The North American market has maintained its upward momentum based on the

increasing sales affected by an aggressive discount policy implemented by Tesla.

The Asian market had its growth led by solid sales made by Hyundai Motor Group.

Amidst gradual increases in the EV market despite comments on a recent slowdown in growth, the EV market in Korea was the only market who recorded degrowth among the top 10 countries in the ranking of EV deliveries. On the other hand, Korea showed the highest growth – 52% - in hybrid vehicles in the world. This can be interpreted as the Korean car market still prefers ICE or hybrid vehicles to electric vehicles. It seems that electric vehicles failed to fully satisfy the demands from customers, except early adapters, who concern about the shortage of charging infrastructure, charging speed, and fire risk. With the entire world showing a strong will to convert to eco-friendly vehicles, though, it is necessary to establish policies and form environments in which customers can drive electric vehicles safely and conveniently.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period